Bitcoin

is a private digital currency that was developed in 2009 as an alternative to the

major currencies of the world. It is not centrally managed, but it is issued

through a small number of licensed websites. The coins are ‘mined’ by

individuals who solve difficult proofs-of-work. These algorithms are generally

to be released in a certain pattern that will have them all published by 2140.

One

of the largest exchanges and banks of Bitcoins is the website Mtgox.com. It is also one of the most infamous.

In June 2011, the website was hacked and the accounts of its users were

compromised. This led to a reported ฿500,000

stolen. This hack led to a suspension of trading and severely damaged the

reputation of Bitcoin. The hack also coincided with the largest bubble in the

currency’s trading history with exchange rates over $30/฿1.

Table 1

Central

banking is all about communication. Central bankers attempt signal their

currencies value, or to signal changes in their currency’s value. This is

similarly true for alternative currencies such as Bitcoin. Because Bitcoin

emerged without a reputation, a large part of its first signal was and is

signaling the public on its process, and the value supposed by that process. A

large part of the attractiveness of Bitcoins is both their scarcity and the

mechanism that ensures their continued scarcity. Bitcoins are only created by

creating new blocks. The proofs which create these blocks are designed to

become more difficult if they are being found more quickly than the design

approves. Bitcoins ultimately have a grand total, when there will not be

additional ones created. This is meant to signal a firm scarcity that is

guaranteed by the logic in the computer programming.

The

Central Bank of Bitcoin tells what the final number of Bitcoins will be. This

is somewhat unique in the currency world. Even the gold standard does not

pretend that there is a known fixed amount of gold, nor that the price of gold

will not float (if not relative to the currency) relative to all other products

and market factors. The final number of a fiat currency is always

(impractically) infinity. Monetary policy makers always have an infinite amount

of currency to perform currency operations. This makes attempting to work

against the Central Bank a hopeless task in a fiat currency, which has its own

value. In practice, currency’s collapse long before infinity and the downfall

of fiat currencies are often attempting to inflate away national debts or

economic depression. This is because while country’s with fiat money supplies

are not subject to runs on a gold standard, they are still subject to balance

of payment deficits which are often (at root) caused by severe national debts.

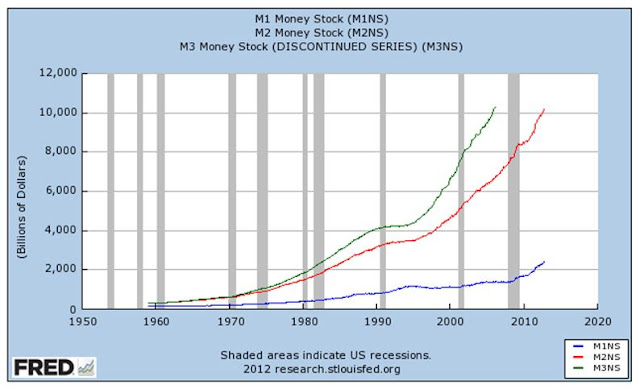

While

managers of fiat money do not publish the final number of currencies that they

will create, or know the final number of currencies that they create; they do

carefully track the amount of money in the economy. They also keep careful

track of the monetary base. In the United States, the recent increase in the

monetary base was a large cause of fear for inflation, as it tripled in the

course of a couple years. Many individuals have predicted strong inflation of

the U.S. dollar because of this factor. This inflation has been, in part,

tempered by a fall in the velocity of money (Table 3), and by paying interest

on excess reserves, which has kept large sums of money out of actual

circulation (Table 4) and other factors.

Table 2

These

predictions of inflation are based on fiat money’s price being a function of

supply and demand. If demand remains static and has a 45⁰ slope, the price should fall by

two/thirds. However, there are many things that go into the demand for

currency. One is the velocity of money, which has fallen considerably during

recession and has continued through the recovery (table 4). Another is a

lurking variable within the supply, excess reserves being held by banks at the

Federal Reserve. At the moment, the U.S. dollar has somewhat low inflation,

even below the inflation target set by the Federal Reserve of 2% (annual).

Table 3

Table 4

There

are three essential purposes to money: a medium of exchange, a unit of account,

and as a store of value. Inflation hawks are essentially concerned about the

latter. Bitcoin is created as competition primarily on these grounds. They are

concerned almost exclusively with controlling the supply, but claim that

because the currency is infinitely divisible, “there is no fear thatwe won’t have enough Bitcoins to

deal with an ever expanding economic base of Bitcoin-denominated transactions.” This could also be described as

attempting to make the most out of deflation. Deflation is terrific if you are

currently holding that currency, but this end game only lends more credence to

criticism that Bitcoin is ultimately more of a Ponzi scheme than alternative

currency.

One

of the major problems with Bitcoin is that despite the fact that it is upfront

about the total number of Bitcoins that can be created, and about the mechanism

by which new Bitcoins are created, it is very opaque about everything else.

Its’ founding and transactions were and are completely anonymous which is

attractive for some, but can also be a source of information asymmetry.

Secondly, because its trade is so limited outside of the few exchanges, one can

argue that it is not even meeting the first definition of money: a medium of

exchange. Indeed even on the most popular Bitcoin trading website, daily

trading volumes are typically below฿100,000.

These low volumes, and low numbers of exchanges have created interesting

results. There are different values for Bitcoins on different exchanges. On

November 28, 2012: btc-e.com has a spot price

of $12.125/ ฿1, bitstamp.nethas

a spot price of $12.16/ ฿1, campbx.com

has a spot price of $12.2/ ฿1,bitfloor.com

has a spot price of $12.32/ ฿1, and the largest exchange mtgox.comhas a spot price of $12.32/ ฿1

as well. All of these exchanges are on the internet, and there are low

transaction costs associated with Bitcoins. It stands to reason that a properly

functioning market would eliminate these obvious opportunities for arbitrage

easily. It seems to me that these are not perfectly efficient markets, but perhaps there are frictions that are

not obvious.

So Bitcoin may not may not be ready for

prime time yet, it is continuing and that is its own victory. It has been

modestly succesful so far and because of the improbability of that success

makes it all the more amazing.

Works Referenced:

Koss, Chris and Mike Koss. “A Bitcoin Primer.” Coinlab.com.

January 1, 2012.

http://coinlab.com/pdfs/a-bitcoin-primer.pdf. Web. (last retrieved 11/28/12).

Mick, Jason. “Inside the Mega-Hack of Bitcoin: the Full

Story.” The Daily Tech. June 19,

2011.

Web. (last

retrieved 11/28/12).

Mishkin, Frederic. The

Economics of Money, Banking, and Financial Markets. New York: Pearson. 2006.

Print. (7th

Edition)

Nakamoto, Satoshi. “Bitcoin: A Peer-to-Peer Electronic Cash

System.” Bitcoin.org.

http://bitcoin.org/bitcoin.pdf. White Paper.

(last retrieved 11/28/12).

Thornton, Henry. An

Inquiry into the Nature and Effects of the Paper Credit. Philadelphia: James

Humphreys. 1807.

Print.

Bitcoincharts.com. “Mt. Gox.”

< http://bitcoincharts.com/charts/>. Web.

(last retrieved 11/28/12).

European Central Bank. “Virtual Currency Schemes.” Frankfurt: European Central Bank. October 2012.

http://www.ecb.int/pub/pdf/other/virtualcurrencyschemes201210en.pdf. Web.

(last retrieved

11/28/12).

FRED.

Saint Louis: Federal Reserve Bank.

< http://research.stlouisfed.org/fred2/>. Web. (last

retrieved

11/28/12).

>>It seems to me that these are not perfectly efficient markets, but perhaps there are frictions that are not obvious.

ReplyDeleteMost exchanges have a trading fee of around 0.5% and additional fees for cashing out dollars or euro. Rest assured that there are hundreds of bots who immediately arbitrage at every oppurtunity.